In today’s fast-paced world, financial literacy has become an essential life skill, making the Evan-Moor Financial Literacy Lessons and Activities for Grades 6-8 an invaluable resource for both educators and parents alike. This engaging workbook aims to equip middle school students with the knowledge they need to navigate the complexities of money management. Whether in a classroom setting or at home, this resource encourages young learners to explore vital concepts like earning, spending, and saving through a variety of interactive activities.

Key Concepts

The Evan-Moor Financial Literacy Workbook is structured to provide hands-on learning through its thoughtfully designed lessons and activities. Here’s a closer look at its key concepts and benefits:

-

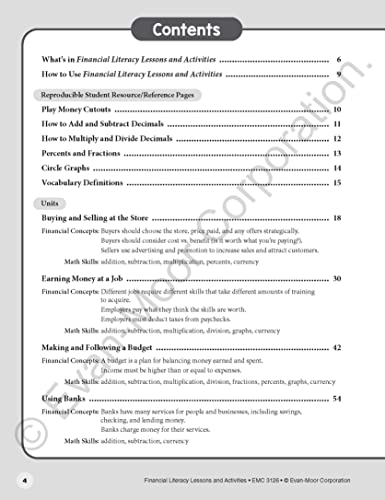

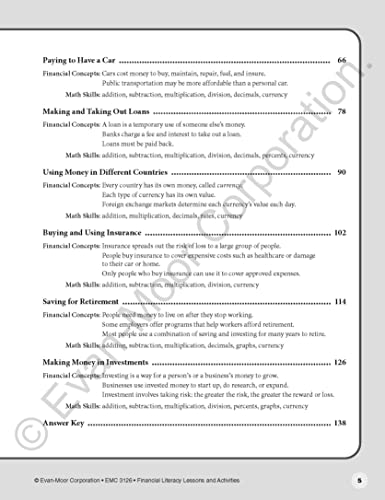

Comprehensive Curriculum: Covering essential topics such as budgeting, banking, and financial decision-making, this workbook ensures a comprehensive understanding of financial literacy. Engaging activities help reinforce these concepts, making learning enjoyable and effective.

-

Support for Different Learning Environments: It’s designed to be versatile, appealing to teachers in a classroom and parents seeking to foster skills at home. The workbook serves as an excellent resource for homeschool families too, offering easy-to-follow lessons that encourage independence and self-directed learning.

-

Engaging, Colorful Design: Children are often drawn to visually stimulating material. The full-color activities in Evan-Moor’s workbook not only capture students’ attention but also make learning more exciting. The vibrant illustrations support varied learning styles and keep students motivated throughout their educational journey.

-

Real-World Application: With a focus on real-life scenarios, the workbook answers the critical question of “Why does this matter?” for young learners. By relating lessons to everyday life, it gives them context, helping students see the importance of making informed financial choices.

Pros & Cons

Pros:

- Hands-On Learning: Many users praise the workbook for its interactive approach, which caters to different learning styles. Activities encourage participation and retention.

- Versatile Use: Whether in a traditional classroom or homeschooling environment, the workbook easily fits into any educational approach.

- Skill Development: Reviewers highlight the foundation it provides in essential life skills, fostering confidence in handling money-related tasks and decisions.

Cons:

- Pacing Concerns: Some critics mention that the material might be too advanced or fast-paced for certain students, particularly those who struggle with math. It may require supplementary instruction to ensure understanding.

- Limited Depth: A few users suggest that while the workbook is a solid introduction, a deeper exploration of financial topics could enhance the learning experience.

Who Is It For?

The Evan-Moor Financial Literacy Workbook is ideally suited for middle school students, particularly those in grades 6-8. It benefits educators seeking to supplement curricula with practical life skills and parents who want to provide their children with a strong foundation in financial literacy at home. This workbook is also a great resource for homeschool families aiming to incorporate essential life skills into their education plans—helping students prepare for real-world financial challenges.

Explore Financial Literacy Activities

Final Thoughts

In conclusion, the Evan-Moor Financial Literacy Lessons and Activities Workbook is more than just a collection of exercises; it’s a gateway to understanding the fundamental aspects of financial literacy. While it boasts numerous strengths—such as engaging activities, versatile applicability, and a robust curriculum—some users have noted areas for improvement regarding pacing and depth. Nonetheless, this resource is a valuable addition to any educational toolkit, empowering young minds to confidently navigate their financial futures. Whether you’re a teacher, a parent, or a homeschool educator, this workbook is designed to make financial literacy approachable and relatable. Investing in this educational tool could be one of the best choices you make for your child’s future.

Unlock Money Management Skills

As an Amazon Associate, I earn from qualifying purchases.