In today’s fast-paced world, financial literacy is a crucial skill that children need to acquire early. Evan-Moor’s Financial Literacy Lessons and Activities for Grade 3 provides a comprehensive resource designed to equip third graders with essential money management skills. This workbook not only introduces young learners to financial concepts but also engages them in hands-on activities that make learning about money fun and effective.

Key Concepts

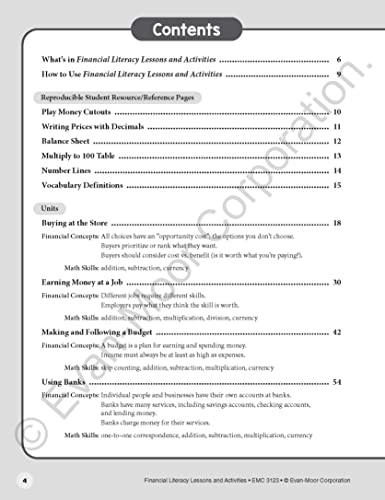

Evan-Moor’s Financial Literacy Lessons is structured around ten robust units, each designed to cover a unique aspect of financial education. Here’s a closer look at the key concepts:

-

Real-World Application: Each unit introduces students to real-life contexts through engaging stories, fostering a relatable learning experience. For instance, children learn how to make and follow a budget or the responsibilities that come with earning money from a job. This relevance to their everyday lives makes the lessons more impactful.

-

Cross-Curricular Activities: The resource blends various subjects like math, reading, and social studies, making financial literacy an integrated part of the learning journey. This approach not only reinforces their understanding of math through money-based word problems but also enhances their vocabulary and comprehension skills alongside.

-

Hands-On Learning: The inclusion of role-playing activities and games encourages collaboration among peers. By simulating real-life scenarios, students can grasp challenging concepts more readily, leading to better retention of knowledge.

-

Teaching Aids: With 144 reproducible pages, the workbook features valuable resources, including cut-out math manipulatives, visual aids, and a glossary. These tools make it easy for educators to bring some of the more complex financial ideas to light, supporting diverse learning styles.

-

Standards-Based: The program aligns with current national and state standards, enabling seamless integration into existing curricula. This adherence to standards ensures that learners receive a high-quality education that meets educational requirements.

Pros & Cons

Pros:

-

Engaging Content: Many users have praised the workbook for being engaging and interactive. One satisfied parent mentioned how their child looked forward to tackling each unit, showing increased enthusiasm for learning about money.

-

Comprehensive Approach: The holistic nature of the lessons helps children understand the relevance of finance in their lives. They learn about various topics, including budgeting, credit, and taxes, in a structured manner.

-

Flexibility in Learning: The reproducible worksheets and manipulatives allow teachers and parents to customize lessons based on each child’s learning pace and style, enhancing the effectiveness of the resource.

Cons:

-

Limited Scope: Some critical reviews indicated that while the workbook is informative, it may benefit from additional activities or examples that explain complex concepts in even simpler terms.

-

Single-Use Limitation: The reproducible nature of the workbook permits copying only for a single classroom or household, which some users found restrictive if multiple children needed access.

Who Is It For?

Evan-Moor’s Financial Literacy Lessons and Activities is ideal for third-grade teachers looking to enrich their math curriculum with practical financial lessons. It’s also perfect for parents who wish to support their children’s education at home, providing a structured yet fun way to teach vital life skills. Moreover, after-school programs focused on life skills can benefit greatly from this product too, making it a versatile teaching resource.

Unlock Financial Skills for Grade 3!

Final Thoughts

Overall, Evan-Moor’s Financial Literacy Lessons and Activities for Grade 3 serves as an essential educational tool that lays the groundwork for responsible money management. With its engaging content, comprehensive approach to financial topics, and adaptability for different learning styles, it stands out as a premier resource for introducing children to the world of finance. While there are minor limitations concerning scope and single-user restrictions, the robust design and award-winning background make it a worthy investment in your child’s education. Helping children navigate their financial futures starts here, and this workbook is a fantastic first step.

Discover Engaging Money Lessons Now!

Shop Financial Literacy Resources for Kids!

As an Amazon Associate, I earn from qualifying purchases.